Car Tax Check

Need a Car Tax Check?

When running a vehicle in the UK, it is crucial that you make sure you pay any and all relevant tax due. It is something which is easy to arrange, but a full tax check will let you know what to expect when buying a new car you wish to tax.

- Our full car tax checker system will let you know if any tax is due to be paid

- We will let you know which factors affect the tax you are likely to pay

- We can also inform you of the genuine value of your car

- A full check will help you to budget for the running of your car in years to come

Unsure how much car tax you should pay on your new vehicle? That isn’t something that all car salespeople will necessarily know. Why not get ahead and start planning your budget with a full tax check?

Unsure how much car tax you should pay on your new vehicle? That isn’t something that all car salespeople will necessarily know. Why not get ahead and start planning your budget with a full tax check?

Why It’s Important to Check Car Tax?

Once you register a car for the first time, you must set up for tax with the DVLA. This is important even if you are registering a used car. Car tax helps to pay towards several services in the UK, such as road repairs and upgrades. Car tax is something that all UK motorists will need to pay. It is one of the first things you should always budget for! However, when buying a second-hand car, it is not always clear how much car tax you might need to pay in the long run. Therefore, a full check will allow you to prepare your finances adequately. It will also likely give you extra buying confidence and might give you a negotiating advantage. There is little reason in buying a car without knowing how much you are going to need to pay each year to keep your vehicle on the road.

Planning Your Vehicle Finances

There are many factors which will impact the price you pay for running your car over the years. A full licence plate check and car tax check will allow you to start building a clear financial picture of what to expect. Factors which can impact running costs may include rising tax, fuel, repairs and MOTs and insurance. With a full check, you can find out precise data to help you plan ahead without any guesswork. While a car salesperson may be able to help you find out more about car tax, it makes sense to access a full report with all the details clear and in front of you. This way, you can make confident, private decisions about the cars you wish to buy.

What is VED?

VED rates refer to British government valuations on how much tax each UK motorist will be due to pay on their vehicles. There are a number of factors which will impact the amount you pay. However, VED rates generally base around vehicle value and emissions. Therefore, it may actually cost you even less to run an energy-efficient car in terms of taxes, too. A full car tax check will advise you how much VED you stand to pay on your vehicle based on several factors. We will take into account all the emissions data and vehicle typing which the DVLA bases their rates on. This way, instead of taking away a vague estimate, you can be sure that our checks will give you a clear picture of what to expect when you first register your vehicle.

How Much Could I Pay in Car Tax?

This will vary from car to car. While a tax check will let you know what to expect from your rates moving forwards, it’s essential to understand what goes into road tax rates. It’s important to keep in mind the following when it comes to car tax impacts and potential costs:

- The type of fuel you use – diesel, petrol or alternative

- The overall listing price of your car or vehicle

- The expected CO2 emissions from your vehicle

- The age of your vehicle

- When your car was last taxed

- You could pay more than £2,000 for your first tax payment

How Much Does It Cost to Run a Car?

The cost of running a car is going to vary from model to model. However, as mentioned, you can expect to pay up to £2,000 in tax for your first year of vehicle ownership. That applies when you first register your vehicle. In addition to this, there will be regular fuel costs, MOTs, and maintenance fees, as well as insurance costs. Running a car can really add up, which is why it is all the more important to run full checks. In fact, our full licence check will help you to plan for these costs, too. Why not take a look at our full report example and see what you could learn about your next car purchase?

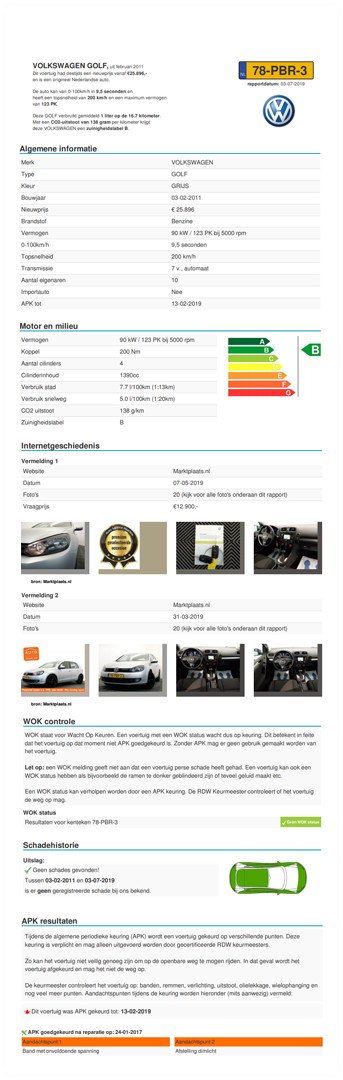

Bereken de actuele waarde van een auto via een kenteken check

You must always tax your car in full online with the UK government and DVLA. Failure to do so may result in substantial fines, and you may even face the crushing or scrapping of your car altogether.

Check kenteken: controleer het schadeverleden, keuringen en kilometerstand

It’s important to know where you stand with car tax. This way, you can make sure you always have enough in your bank to pay the fees from year to year.

Doe een online kentekencheck

Unsure how much you might need to pay for car tax? Your salesperson might be able to help, but it is quicker and more reliable to take out a full car tax check online. Our full check reports offer comprehensive data which will give you definitive answers to difficult questions.

Need a Car Tax Check?

If you are buying a car, you must make sure you check tax status. Why not use our service to find out full details?

Further Benefits of a Car Tax Check

Unsure whether or not a car tax checking service is going to help you? Here are a few final thoughts.

Het rapport dat je downloadt bevat de onderstaande informatie:

Keep Your Car Road Legal

Understanding your tax ahead of time will help you to ensure you follow legal guidelines.

Plan Your Budget

Along with other car budgeting preparations, make sure you can feasibly afford tax.

Make the Right Choice

Knowing your car’s potential tax will help you to make the right vehicle choice for you.

Get Ahead in Negotiations

Need leverage when buying a car? Find out full tax information for extra confidence.

Be Clear on All Fronts

We offer more than just tax checking – find out your car’s full history

Understand Your Current Status and Rights

Find out whether or not tax is already paid on your car, and what you should do next.

Prepare to Lower Tax

Use the information in your report to make plans on reducing emissinons and your tax bill.

Bandenmaten

Dit zijn de maten van banden zoals origineel geleverd: voor én achter.

Wegenbelasting

De motorrijtuigenbelasting per provincie en indien mogelijk: zakelijke en particuliere tarieven.

Schadehistorie Check

Datum van de schademelding, kilometerstand, het schadebedrag en de positie van de desbetreffende schade.

Advertentie geschiedenis

Advertentiedatum, bronvermelding, foto’s van het voertuig en de vraagprijs.

Maten en gewichten

voertuiglengte, maar ook de breedte en hoogte. Verder ook informatie over de wielbasis, spoorbreedte, massa rijklaar, maximale laadvermogen, daklasting, aanhanger ongeremd, aanhanger geremd en laadruimte inhoud.

Eigenarenhistorie

Registratiedatum, type eigenaar: bedrijf, lease of particulier en aantal dagen eigenaar.

Onderstel

Wielophanging voor/achter, achtervering voor/achter, stabilisator voor/achter remmen voor/achter en draaicirkel.

Tellerhistorie check

RDW controle km-stand, bij ons bekende KM-stand, datum, Nationale Autopas controle en NAP check.

Waarderapport

Aankoop adviesprijs, inruilwaarde, handelswaarde en catalogusprijs.

Overige informatie

Uitvoering, BPM bedrag, handelsbenaming, variant, carrosserie, compressieverhouding, eurolabel, geluid rijdend/stationair, kleppenbediening en tankinhoud.